Introduction

Chiavari chairs are a popular choice for events and weddings due to their elegant and lightweight design. However, transporting and storing them can be a challenge. This guide will provide you with tips on how to safely transport and store Chiavari chairs. It will cover the best practices for loading and unloading the chairs, as well as the best methods for storing them. With the right knowledge and preparation, you can ensure that your Chiavari chairs remain in perfect condition for years to come.

How to Properly Stack and Secure Chiavari Chairs for Transport

Transporting Chiavari chairs requires careful planning and preparation to ensure that the chairs are properly secured and stacked for safe transport. This guide will provide step-by-step instructions on how to properly stack and secure Chiavari chairs for transport.

Step 1: Gather the Necessary Supplies

Before you begin stacking and securing the chairs, you will need to gather the necessary supplies. You will need a flatbed truck or trailer, ratchet straps, and a tarp or blankets to cover the chairs.

Step 2: Secure the Chairs

Once you have gathered the necessary supplies, you can begin to secure the chairs. Start by placing the chairs on the flatbed truck or trailer. Make sure that the chairs are placed in an orderly fashion and that they are not overlapping. Once the chairs are in place, use the ratchet straps to secure them to the flatbed. Make sure that the straps are tight and that the chairs are firmly secured.

Step 3: Cover the Chairs

Once the chairs are secured, you can cover them with a tarp or blankets. This will help protect the chairs from the elements and ensure that they remain secure during transport. Make sure that the tarp or blankets are securely fastened to the flatbed and that they are covering the chairs completely.

Step 4: Secure the Load

Once the chairs are covered, you can secure the load. Use additional ratchet straps to secure the tarp or blankets to the flatbed. Make sure that the straps are tight and that the load is firmly secured.

Step 5: Transport the Chairs

Once the chairs are properly secured and stacked, you can transport them to their destination. Make sure to drive carefully and to follow all safety protocols when transporting the chairs.

By following these steps, you can ensure that your Chiavari chairs are properly stacked and secured for transport. This will help ensure that the chairs arrive safely and in good condition.

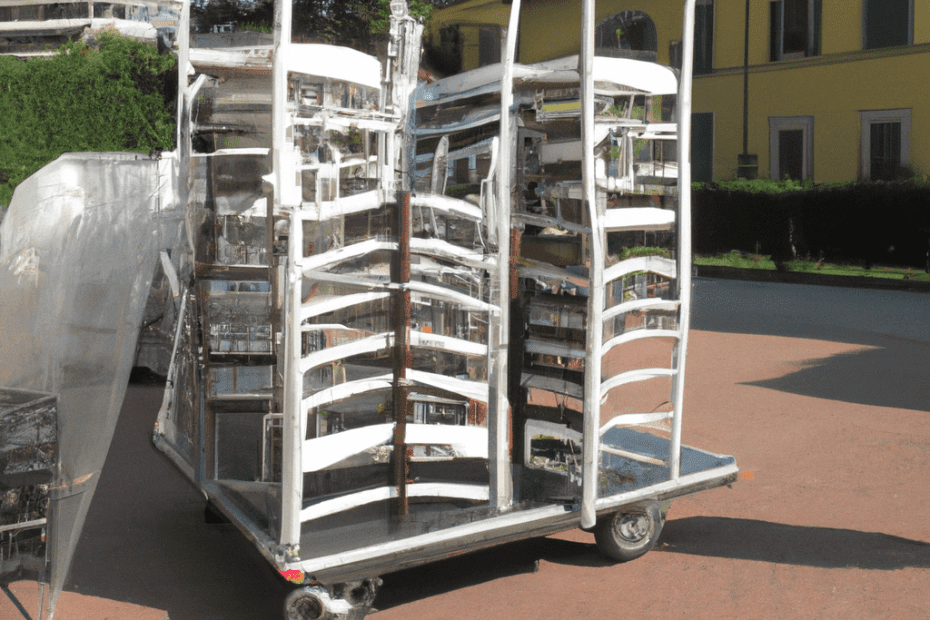

The Benefits of Using a Chiavari Chair Cart for Transport

Chiavari chair carts are an invaluable tool for anyone who needs to transport chairs from one location to another. These carts are designed to make the process of moving chairs easier and more efficient, and they offer a number of benefits that make them a great choice for any event or venue.

First, chiavari chair carts are designed to be lightweight and easy to maneuver. This makes them ideal for transporting chairs up and down stairs or through tight spaces. The carts are also designed to be collapsible, so they can be easily stored when not in use. This makes them a great choice for venues that need to store chairs when not in use.

Second, chiavari chair carts are designed to be durable and long-lasting. The carts are made from high-quality materials that are designed to withstand the rigors of regular use. This means that the carts will last for many years, even with regular use. This makes them a great investment for any venue that needs to transport chairs regularly.

Third, chiavari chair carts are designed to be safe and secure. The carts are designed with safety features such as non-slip surfaces and secure straps that keep the chairs in place during transport. This ensures that the chairs will remain safe and secure during transport, and that they will arrive at their destination in one piece.

Finally, chiavari chair carts are designed to be cost-effective. The carts are relatively inexpensive, and they can be used for many years without needing to be replaced. This makes them a great choice for venues that need to transport chairs regularly but don’t want to invest in expensive equipment.

Overall, chiavari chair carts are an invaluable tool for anyone who needs to transport chairs from one location to another. The carts are lightweight, durable, safe, and cost-effective, making them a great choice for any venue that needs to transport chairs regularly.

How to Choose the Right Chiavari Chair Cart for Your Needs

When it comes to choosing the right chiavari chair cart for your needs, there are a few important factors to consider. First, you need to determine the size of the cart you need. Chiavari chair carts come in a variety of sizes, from small carts that can hold up to four chairs to larger carts that can hold up to twelve chairs. You should also consider the weight capacity of the cart, as this will determine how many chairs it can hold.

Next, you should consider the type of material the cart is made from. Chiavari chair carts are typically made from either metal or wood. Metal carts are usually more durable and can hold more weight, while wood carts are lighter and more aesthetically pleasing.

Finally, you should consider the features of the cart. Some carts come with wheels for easy maneuverability, while others are stationary. Some carts also come with shelves or drawers for additional storage. When choosing a cart, make sure to consider the features that will best suit your needs.

By taking the time to consider these factors, you can ensure that you choose the right chiavari chair cart for your needs. With the right cart, you can easily transport your chairs to and from events, making your life much easier.

Tips for Safely Loading and Unloading Chiavari Chairs

Loading and unloading Chiavari chairs can be a tricky task, but with the right precautions, it can be done safely and efficiently. Here are some tips to help you safely load and unload Chiavari chairs:

1. Wear the right protective gear. When loading and unloading Chiavari chairs, it is important to wear the right protective gear, such as gloves, safety glasses, and steel-toed boots. This will help protect you from any potential injuries.

2. Use the right equipment. When loading and unloading Chiavari chairs, it is important to use the right equipment. This includes a dolly or cart to help move the chairs, as well as straps or ropes to secure them in place.

3. Lift with your legs. When lifting Chiavari chairs, it is important to use proper lifting techniques. Always lift with your legs and not your back, as this will help prevent any potential injuries.

4. Secure the chairs. When loading and unloading Chiavari chairs, it is important to secure them in place. This can be done by using straps or ropes to tie the chairs down.

5. Take your time. When loading and unloading Chiavari chairs, it is important to take your time and be careful. Rushing can lead to accidents, so it is important to take your time and be mindful of your surroundings.

By following these tips, you can help ensure that you are loading and unloading Chiavari chairs safely and efficiently.

The Best Way to Store Chiavari Chairs for Long-Term Use

Chiavari chairs are a popular choice for events and venues due to their lightweight design and elegant look. However, if you plan to store them for long-term use, there are certain steps you should take to ensure they remain in good condition.

First, it is important to clean the chairs before storing them. This will help prevent the buildup of dirt and dust, which can damage the chairs over time. Use a damp cloth to wipe down the chairs, and then dry them thoroughly.

Once the chairs are clean, you should inspect them for any damage. If you find any cracks or chips, repair them before storing the chairs. This will help prevent further damage and ensure the chairs remain in good condition.

Next, you should wrap the chairs in a protective material. Bubble wrap or plastic sheeting are both good options. This will help protect the chairs from dust, moisture, and other environmental factors.

Finally, you should store the chairs in a cool, dry place. Avoid storing them in direct sunlight or in areas with high humidity. This will help prevent the chairs from warping or becoming damaged.

By following these steps, you can ensure that your Chiavari chairs remain in good condition for long-term use.

How to Protect Chiavari Chairs from Damage During Storage

Properly storing Chiavari chairs is essential for protecting them from damage. With the right care and maintenance, these chairs can last for many years. Here are some tips for protecting Chiavari chairs during storage:

1. Clean the chairs before storing them. Make sure to remove any dirt, dust, or debris from the chairs. This will help prevent any damage from occurring during storage.

2. Cover the chairs with a protective material. Use a breathable fabric such as canvas or muslin to cover the chairs. This will help protect them from dust, dirt, and moisture.

3. Store the chairs in a cool, dry place. Avoid storing the chairs in direct sunlight or in areas with high humidity. This will help prevent the chairs from warping or cracking.

4. Stack the chairs properly. Make sure to stack the chairs in an upright position and use a stable base to support them. This will help prevent the chairs from tipping over and becoming damaged.

5. Use a storage rack. If possible, use a storage rack to store the chairs. This will help keep the chairs organized and prevent them from becoming damaged.

By following these tips, you can help protect your Chiavari chairs from damage during storage. With the right care and maintenance, these chairs can last for many years.

The Benefits of Using a Chiavari Chair Cover for Storage

Chiavari chair covers are an excellent way to store and protect your chairs. These covers are designed to fit snugly over the chairs, providing a layer of protection from dust, dirt, and other debris. They also help to keep the chairs looking their best, as they can be easily removed and washed when needed.

The covers are made from a variety of materials, including polyester, cotton, and spandex. This allows them to be lightweight and durable, while still providing a snug fit. The covers are also available in a variety of colors and patterns, so you can find one that matches your decor.

The covers are easy to install and remove, making them ideal for use in both indoor and outdoor settings. They are also easy to store, as they can be folded up and stored away when not in use. This makes them a great option for those who need to store their chairs in a small space.

The covers are also great for protecting the chairs from spills and other accidents. They can be easily wiped down with a damp cloth, and they are also resistant to water and other liquids. This makes them ideal for use in areas where spills are likely to occur.

Finally, the covers are also great for protecting the chairs from the elements. They can be used to protect the chairs from the sun, wind, and rain, as well as from dirt and dust. This makes them a great choice for those who need to store their chairs outdoors.

Overall, using a Chiavari chair cover for storage is an excellent way to keep your chairs looking their best and protected from the elements. They are easy to install and remove, and they are also lightweight and durable. They are also available in a variety of colors and patterns, so you can find one that matches your decor. With all of these benefits, it is easy to see why these covers are a great choice for those who need to store their chairs.

How to Choose the Right Chiavari Chair Cover for Your Needs

When it comes to selecting the right chiavari chair cover for your needs, there are a few key factors to consider. First, you should consider the size of the chair cover. Chiavari chair covers come in a variety of sizes, so it is important to measure the chair before purchasing a cover. Additionally, you should consider the material of the cover. Chiavari chair covers are typically made from polyester, spandex, or cotton. Each material has its own unique benefits, so it is important to select the material that best suits your needs.

Next, you should consider the color of the cover. Chiavari chair covers come in a variety of colors, so it is important to select a color that will complement the overall look of your event. Additionally, you should consider the design of the cover. Chiavari chair covers come in a variety of designs, so it is important to select a design that will fit the theme of your event.

Finally, you should consider the cost of the cover. Chiavari chair covers can range in price, so it is important to select a cover that fits within your budget. Additionally, you should consider the quality of the cover. Chiavari chair covers are typically made from high-quality materials, so it is important to select a cover that will last for years to come.

By considering these key factors, you can ensure that you select the right chiavari chair cover for your needs. With the right cover, you can create a beautiful and elegant look for your event.

Tips for Properly Cleaning and Maintaining Chiavari Chairs

Chiavari chairs are a popular choice for events and venues due to their elegant design and durability. Properly cleaning and maintaining these chairs is essential to ensure they remain in good condition and last for years to come. Here are some tips for properly cleaning and maintaining Chiavari chairs:

1. Clean the chairs regularly. Dust and dirt can accumulate on the chairs over time, so it is important to clean them regularly. Use a soft cloth and a mild detergent to wipe down the chairs. Avoid using harsh chemicals or abrasive materials, as these can damage the chairs.

2. Inspect the chairs regularly. Check the chairs for any signs of wear and tear, such as loose screws or cracks in the wood. If any damage is found, it should be repaired immediately to prevent further damage.

3. Store the chairs properly. When not in use, the chairs should be stored in a dry, cool place. Avoid storing the chairs in direct sunlight or in humid areas, as this can cause the wood to warp or crack.

4. Polish the chairs regularly. Use a wood polish to keep the chairs looking their best. This will help protect the wood from scratches and other damage.

5. Avoid stacking the chairs. Stacking the chairs can cause them to become unstable and can lead to damage. If the chairs must be stacked, use a stacking cart to ensure they are properly supported.

By following these tips, you can ensure your Chiavari chairs remain in good condition and last for years to come.

The Best Way to Disassemble and Reassemble Chiavari Chairs for Transport and Storage

Chiavari chairs are a popular choice for events and venues due to their elegant design and lightweight construction. However, transporting and storing them can be a challenge due to their delicate nature. To ensure that your Chiavari chairs remain in good condition, it is important to properly disassemble and reassemble them for transport and storage.

To begin, you will need to gather the necessary tools for disassembly. These include a Phillips head screwdriver, a flathead screwdriver, and a pair of pliers. Once you have the tools, you can begin the process of disassembling the chairs.

Start by removing the seat cushion from the chair frame. This can be done by unscrewing the four screws located on the underside of the seat. Once the screws are removed, the cushion can be lifted off the frame.

Next, remove the seat back from the frame. This can be done by unscrewing the four screws located on the back of the seat. Once the screws are removed, the seat back can be lifted off the frame.

Once the seat and seat back have been removed, you can begin to disassemble the frame. Start by unscrewing the four screws located on the sides of the frame. Once the screws are removed, the frame can be separated into two pieces.

Finally, remove the legs from the frame. This can be done by unscrewing the four screws located on the bottom of the frame. Once the screws are removed, the legs can be lifted off the frame.

Once the chair has been disassembled, it is important to properly store the pieces. The seat cushion and seat back should be stored in a dry, dust-free environment. The frame and legs should be stored in a cool, dry place.

When it is time to reassemble the chair, start by attaching the legs to the frame. This can be done by screwing the four screws located on the bottom of the frame. Once the screws are tightened, the legs should be firmly attached to the frame.

Next, attach the seat back to the frame. This can be done by screwing the four screws located on the back of the seat. Once the screws are tightened, the seat back should be firmly attached to the frame.

Finally, attach the seat cushion to the frame. This can be done by screwing the four screws located on the underside of the seat. Once the screws are tightened, the seat cushion should be firmly attached to the frame.

By following these steps, you can ensure that your Chiavari chairs are properly disassembled and reassembled for transport and storage. This will help to ensure that your chairs remain in good condition and are ready for use when needed.

Q&A

1. How should Chiavari chairs be transported?

Chiavari chairs should be transported in a secure, upright position, preferably in a van or truck. If possible, use a dolly or cart to move the chairs from one location to another.

2. How should Chiavari chairs be stored?

Chiavari chairs should be stored in a dry, cool, and dust-free environment. If possible, store the chairs in a climate-controlled area.

3. How should Chiavari chairs be stacked?

Chiavari chairs should be stacked in an alternating pattern, with the legs of one chair resting on the seat of the next chair. This will help to prevent the chairs from slipping or tipping over.

4. How should Chiavari chairs be secured when transporting?

Chiavari chairs should be secured with straps or bungee cords when transporting. This will help to prevent the chairs from shifting or falling over during transport.

5. How should Chiavari chairs be cleaned?

Chiavari chairs should be cleaned with a mild soap and water solution. Avoid using harsh chemicals or abrasive cleaners, as these can damage the finish of the chairs.

6. How often should Chiavari chairs be inspected?

Chiavari chairs should be inspected regularly for signs of wear and tear. Any damaged or broken chairs should be repaired or replaced immediately.

7. How should Chiavari chairs be maintained?

Chiavari chairs should be maintained by regularly cleaning and inspecting them. Additionally, the chairs should be lubricated with a light oil or wax to help protect the finish.

8. How should Chiavari chairs be protected from the elements?

Chiavari chairs should be protected from the elements by storing them in a dry, cool, and dust-free environment. If possible, store the chairs in a climate-controlled area.

9. How should Chiavari chairs be moved?

Chiavari chairs should be moved using a dolly or cart. This will help to prevent the chairs from being damaged during transport.

10. How should Chiavari chairs be secured when not in use?

Chiavari chairs should be secured with straps or bungee cords when not in use. This will help to prevent the chairs from shifting or falling over.

Conclusion

Transporting and storing Chiavari chairs can be a difficult task, but with the right tools and techniques, it can be done safely and efficiently. By using the right materials, such as furniture dollies and protective covers, and following the proper steps, such as stacking the chairs properly and securing them with straps, you can ensure that your Chiavari chairs are transported and stored safely and securely.

- how to paint chiavari chairs - April 8, 2024

- how to make chiavari chairs - April 8, 2024

- how to decorate chiavari chairs - April 8, 2024